Accessibility in finance: Insights, challenges and progress

Fable recently surveyed our community of assistive technology users to learn about their experiences with financial services. We asked questions about online and mobile banking, insurance, investments, financial management, tax preparation, and payment services. How accessible are these services? What could make them better? And why might a person pick one service over another?

What’s important to customers with disabilities

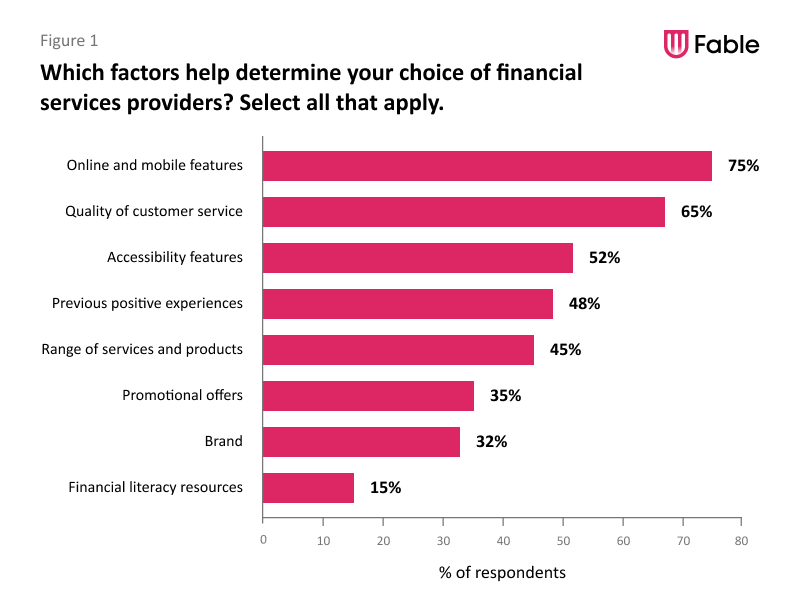

According to Fable’s Insights survey, 75% of respondents said the most important factor for them is the specific features offered by financial services. Customer service quality came next, with 65% placing it as a priority. Accessibility was the third most important factor, with 52% of respondents considering it a key factor. In contrast, accessibility was respondents’ top concern when it comes to online shopping.

“Software feedback was very usable, and everything was predictable as to entering in different fields of the forms. It was very empowering to know that I could do my own taxes without assistance.”

– Guy C.

Opportunity to improve user experience

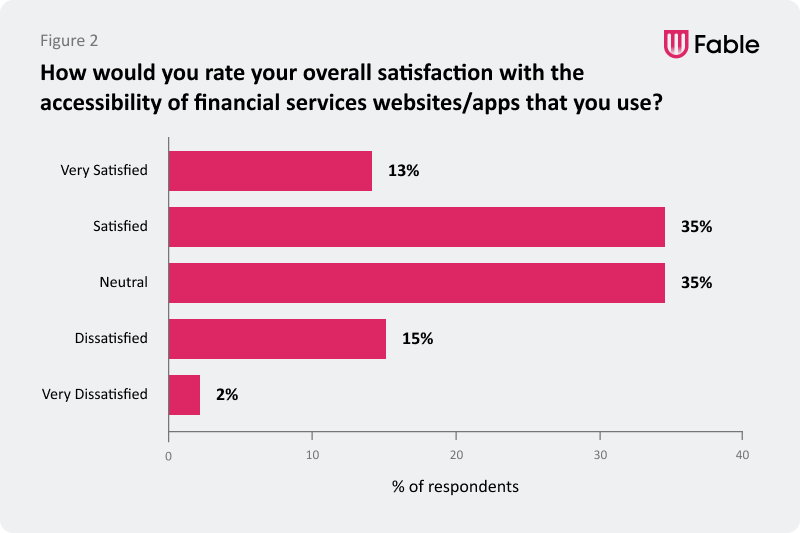

While the finance industry may appear to be more accessible than others, there’s still plenty of room for improvement. Only 35% of respondents said they were “satisfied” with the accessibility of their financial services’ websites and apps, and just 13% were “very satisfied.” This means 52% of participants were either dissatisfied or indifferent about the services they use.

“I appreciate the ease of use with my current bank. I’ve seen other banks do a worse job and have actually left them because of that.”

– Angelica C.

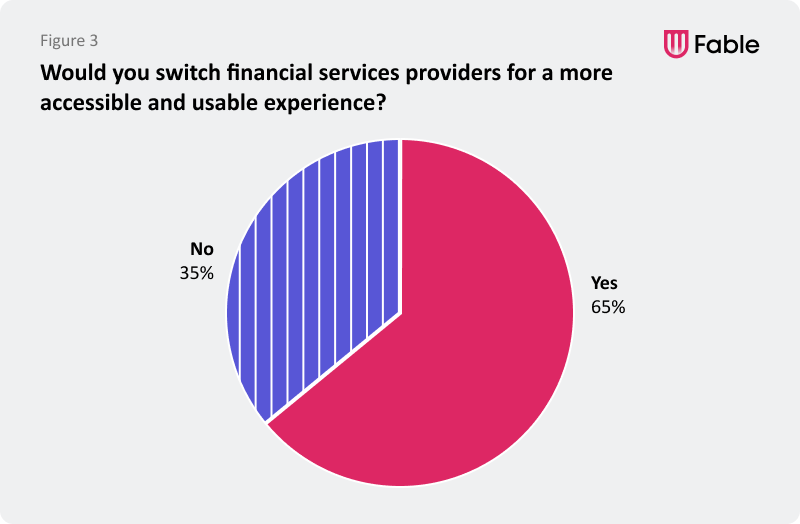

If the services that people with disabilities need aren’t accessible, customers won’t hesitate to seek options elsewhere. In fact, 2 out of 3 respondents said they would switch service providers for an experience that was more accessible and usable to them.

Consistent inconsistency

Many of the accessibility issues respondents reported came down to an inconsistent experience across platforms. Many had a website that worked with their assistive technology, but a mobile app that did not, or vice versa. Another issue being specific barriers or challenges that made dealing with their finances frustrating at best and impossible at worst.

Statements and documents

Accessibility of financial statements had the lowest rate of satisfaction compared to other financial tools and services. Respondents said that it was difficult to read their statements, both digitally and in print. This made it more difficult for them to check their accounts and feel confident about their finances. Some respondents reported that even the task of finding statements in the first place to be difficult.

“My bank statements are PDFs. Sometimes I can read them with my screen reader. Usually, I cannot because they seem to be jumbled up. If the forms were properly tagged for accessibility then it would be easier for me to balance my checkbook.”

– Sheri R.

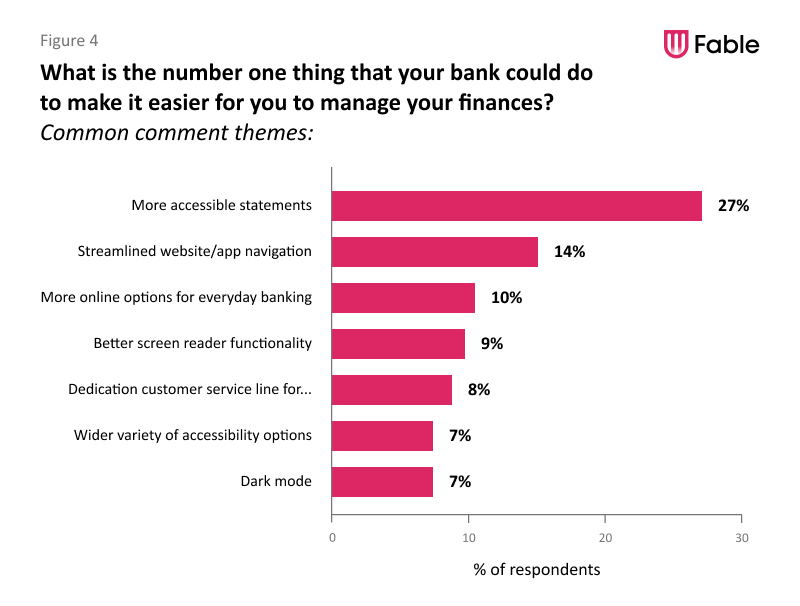

When asked what the number one thing their bank could do to help them manage their finances, 27% of respondents said more accessible statements would make the biggest difference.

Security features

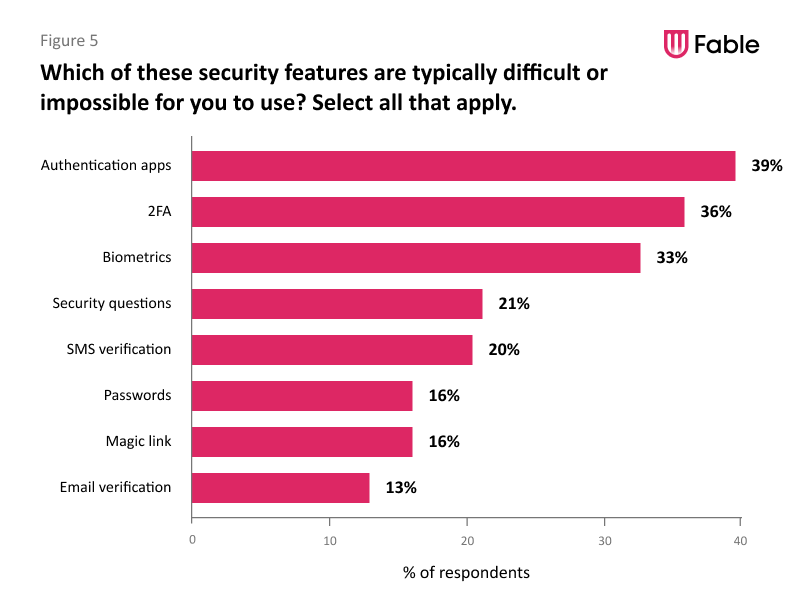

Another pain point that respondents reported was the wide variety of security methods that financial sites use. Users with disabilities found common security features challenging, including authentication apps (39%), 2-factor authentication (2FA) (36%), and biometrics like face and fingerprint recognition (33%). While these methods are helpful for some people with disabilities, others struggle to use them.

Face ID does not work for me because I use very dark sunglasses and my eyes shake a bit so even without the sunglasses they are not able to be captured.

– Alyson S.

Participants also noted that security checks, like those that require photographing IDs, can be challenging to complete independently. These processes often assume users will take a new photo with their webcam or phone camera, without giving them the option to upload a scanned photo they already have.

Another example would be CAPTCHA services, which are meant to enhance security but can be difficult for users with disabilities. Often, CAPTCHAs are not designed to be accessible. In some cases, they may even confuse assistive technology with automated bots. Even when alternative options are available, they can still be very frustrating for people with cognitive challenges, such as dyslexia.

“I couldn’t see clearly what the images were on the CAPTCHA [and] the audio recording I was supposed to listen to and write back was just too muffled to even tell what they were saying. I ended up spending almost 10 minutes just trying to refresh to get a new prompt that I could actually make sense of.”

– Jules P.

Privacy

There is a big overlap between security features and privacy for customers with disabilities. If a feature isn’t accessible to them, they may have to decide whether to ask another person for help. Asking for help with a financial system can mean giving up privacy, something that many people without disabilities might ever consider, but can also come with actual risk.

“I prefer to do deposits through the mobile app. The only drawback is that I need physical assistance (less privacy) to take photos when doing mobile check deposits.”

– Remon J.

Having to rely on a friend, family member, or stranger to help with sensitive financial tasks is a privacy risk that no one likes but is a reality for many people with disabilities. It results in a lack of independence, which can be frustrating at best and demoralizing at worst.

“Honestly, the positive experiences [with financial services] are so few and far between that my wife prefers to manage our financial accounts. My attempts to do so often end in frustration, anxiety, and depression.

– Robert P.

Creating equal access for everyone

“In the 14 years that I have been banking with my primary financial institution online, I have not experienced any accessibility barriers while using their website. The site is very easy to log into and navigate, and everything is labelled and designed in a way that allows me to easily identify and interact with all of the elements on the page. I am able to download and read my bank statements in an accessible PDF format, which makes it easy for me to verify my statements.”

– Siena T.

One of the biggest takeaways from this study was that people with disabilities are attracted to financial services for the same reasons customers without disabilities are. Customers seek out features and tools that support their financial goals, as well as high quality customer support to use those tools effectively.

Secondly, respondents want and expect financial tools to be accessible so they can manage their finances on their own. The reality is that accessible services give people more than privacy. They also give people control over their everyday lives.

For businesses, this is critical when it comes to brand loyalty and retention. If customers with disabilities find a service that’s the total package, they’ll often stick around.

Unlocking inclusive opportunities in financial services

When thinking about the accessibility of your financial services, it’s important to look beyond just your website and app. Make sure all users can access your services confidently and independently. Consider how easily customers can find, read, and understand documents. Even if you’re not stopping customers from using your tools and services, you might be limiting their ability to use them to their full potential.

Designing and building financial tools that work for everyone can be a challenge, but it’s far from impossible. Connecting directly with the disability community and incorporating regular feedback from your customers with disabilities is a proactive way to not only improve your products and customer experiences, but to innovate. If you’re interested in getting direct feedback from people with disabilities or training your digital teams on building more inclusive products, schedule a demo of Fable today.